Page 14 - annual report

P. 14

FINANCIALS A REPORT

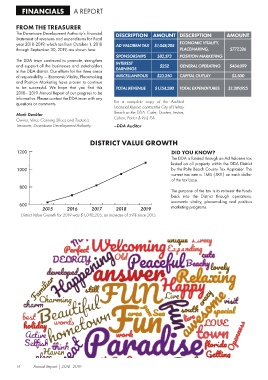

FROM THE TREASURER DESCRIPTION AMOUNT DESCRIPTION AMOUNT

The Downtown Development Authority’s Financial AD VALOREM TAX $1,048,205 ECONOMIC VITALITY, $777,326

Statement of revenues and expenditures for fiscal $82,573 PLACEMAKING,

year 2018-2019, which ran from October 1, 2018 SPONSORSHIPS $252 POSITION MARKETING $434,099

through September 30, 2019, are shown here. INTEREST $23,250 $3,500

EARNINGS GENERAL OPERATING

The DDA team continued to promote, strengthen MISCELLANEOUS

and support all the businesses and stakeholders CAPITAL OUTLAY

in the DDA district. Our efforts for the three areas

of responsibility — Economic Vitality, Placemaking TOTAL REVENUE $1,154,280 TOTAL EXPENDITURES $1,209,925

and Position Marketing have proven to continue

to be successful. We hope that you find this For a complete copy of the Audited

2018– 2019 Annual Report of our progress to be Financial Report, contact the City of Delray

informative. Please contact the DDA team with any Beach or the DDA. Caler, Donten, Levine,

questions or comments. Cohen, Porter & Veil, P.A.

Mark Denkler –DDA Auditor

Owner, Vince Canning Shoes and Tootsie’s

Treasurer, Downtown Development Authority

DISTRICT VALUE GROWTH

1200 DID YOU KNOW?

1000 The DDA is funded through an Ad Valorem tax

levied on all property within the DDA District

800 by the Palm Beach County Tax Appraiser. The

current tax rate is 1MIL (.001) on each dollar

600 2015 2016 2017 2018 2019 of the tax base.

The purpose of the tax is to reinvest the funds

back into the District through operations,

economic vitality, placemaking and position

marketing programs.

District Value Growth for 2019 was $1,048,205, an increase of 59% since 2015.

14 Annual Report | 2018–2019